Keeping fuel subsidy limited to target class as Small Trade and Peasantry Killed!Government announces bailout package for oil cos; diesel, cooking gas to cost more!Finance Ministry clears 18 FDI proposals worth Rs 2,126 crore!Subsidies on fuel, fertilisers & irrigation are bad: D Subbarao!

Tight monetary policy impacting growth: Pranab

FDI in retail to create 10 million jobs over 3 years: Anand Sharma

Kishanji was tortured and brutally killed, say Maoists; CRPF says 'young cops have done a good job'Reminding the UPA-II government about the need to reverse the negative perception of a 'decision-making paralysis', industry body Assocham made a pitch for second generation reforms in various sectors, including finance, banking, taxation and agriculture.

Troubled Galaxy Destroyed Dreams ,Chapter 715

Palash Biswas

http://indianliberationnews.com/

http://indianholocaustmyfatherslifeandtime.blogspot.com/

http://basantipurtimes.blogspot.com/

FDI in Retail: The Game Changer

FDI in retail: Farmers gain, but SMEs & kiranas complain

Direct purchase from farms has hugely benefited small farmers like us who were not getting good returns by selling in the local mandi.

- Nod to multi-brand FDI an imp step: Walmart

- Indian consumption story yet to begin: Biyani

- Consumers to get quality goods at low prices

- States to ensure FDI in multi-brand retail

- India to outline plans for foreign retailers

http://economictimes.indiatimes.com/news/economy/finance/finance-ministry-clears-18-fdi-proposals-worth-rs-2126-crore/articleshow/10870915.cms

| | Dasgupta dials Chidambaram, alleges Kishenji murderedNDTV - 37 minutes ago Kolkata/ Delhi: Claiming he had information that Maoist leader Kishenji was arrested and "murdered in cold blood", Communist Party of India (CPI) MP Gurudas Dasgupta on Friday telephoned Home Minister P. Chidambaram to demand a probe into the death. RelatedKishenji »West Bengal »Andhra Pradesh » CRPF under fire for Kishenji's killing, defends itselfHindustan Times Post Kishenji, security forces hunt for MaoistsEconomic Times From West Bengal:Kishenji's mother alleges 'fake' encounterindiablooms In Depth:'Killing Maoist leaders will not solve the issue'Rediff |

|

Finance Ministry clears 18 FDI proposals worth Rs 2,126 crore!Reforms Drive is in Topmost Gear Now in Absence of Nationwied Mass Movement or Resistance whatsoevr. Ruling Hegemony has Launched a DEMOLITION Drive of Peasantry, Excluded Communities, Small Traders and Working Class! Irony is that the Entertaining Information Network has made the Public Opinion Favourable for the Agenda of Mass Destruction!

India's growth story is still "credible" and the move to open up the economy to global supermarket chains will help growth and control inflation, RBI governor Duvvuri Subbarao said on Friday.

"It's commendable that government has taken the initiative. Let's hope that it will improve the logistics chain and supply chain management in agriculture," Subbarao said in a speech in Chandigarh.

Late Thursday, the government approved 51 percent foreign direct investment in the supermarket sector, paving the entry of firms such as Wal-Mart, Tesco and Carrefour into one of the world's largest untapped markets.

"It's important for not only raising overall growth but also important for containing inflation and improving quality of life over 50 percent of population," Subbarao said.

Opening up the retail sector to global players has been a much awaited reform but has been long hobbled by political differences. The Congress-led government's biggest ally Trinamool Congressis opposed to the move.

The RBI chief said that inflation needs to be brought down to 5 percent initially and then even lower, consistent with India's integration with global economy.

Subbarao said the current inflation situation is a consequence of both supply shocks and demand pressures.

Monetary tightening needs to be supplemented by supply side measures to raise potential economic output, he said.

"Raising agricultural production and productivity is, important for containing price pressures, raising rural incomes and making growth more inclusive," Subbarao said.

India's inflation, which is largely driven by high food and global commodity prices, plus expansive fiscal policies, is the highest among major economies in Asia. It's wholesale prices rose more than expected in October as the cost of food and fuel increased.

The high inflation print, above 9 percent for the 11th month, was further evidence of the Reserve Bank of India's (RBI) inability to achieve a breakthrough in its fight against inflation despite 13 rate rises since March 2010.

In its Oct. 25 mid-quarter review of monetary policy, the RBI had said that a rate hike may not be warranted if inflationary pressures start to ease by December.

Slowing growth, stubbornly high inflation, rising interest rates, political gridlock, gloom in the West and a sliding rupee have conspired to dampen investor and corporate sentiment in Asia's third-largest economy.

The RBI has lowered the country's growth forecast to 7.6 percent for the current fiscal year ending in March from 8 percent previously.

Subbarao says a reduction of federal and state fiscal deficits are important steps for a stable macro environment.

India's fiscal deficit during April to September was 2.92 trillion rupees, or 70.8 percent of the full-year target, government data showed. Most expect it to breach the 4.6 percent of GDP target for the fiscal year.

The government said it would sell debt worth 2.2 trillion rupees, sharply above the budgeted 1.67 trillion rupees in the October to March period.

Subbarao said that India being a emerging economy with a partly open capital account, floating exchange rate and a monetary policy that takes into account global developments, has to continue to manage the "impossible trinity."

The impossible trinity refers to the economic hypothesis that a country simultaneously cannot have a fixed exchange rate, an open capital account and an independent monetary policy.

Rupee volatility to remain

Subbarao said the volatility in the foreign exchange market will remain until the euro zone crisis is resolved.

"Until there is a credible solution to the sovereign debt problem in Europe, we will see movements in the exchange rate," Subbarao said.

He added that the central bank is watching the rupee, but could not say whether it will intervene in the forex market directly.

The rupee has skidded nearly 17 percent from a 2011 high reached in late July as risk-averse investors flee emerging markets, increasing the difficulties for a government already struggling with high inflation, slowing economic growth and a widening trade gap.

The rupee touched an all-time low of 52.73 on Tuesday and state-run banks were spotted selling dollars in the market in recent sessions, sparking talk of RBI intervention.

On Wednesday, RBI deputy governor Subir Gokarn said intervention has been aimed at smoothing sharp movements in the rupee.

India's tryst with retail FDI: In pics

India's tryst with retail FDI: In pics

SHOW THUMBNAILS

In a major push to reforms, India Thursday allowed global chains like Wal-Mart, Carrefour and 7-Eleven to bring up to 51 percent foreign equity to open multi-brand retail stores despite opposition by some allies in the ruling coalition. Also allowed is 100-percent equity in single brand retailing. Reuters

24/11/2011

India Inc hails FDI in retail

India Inc today hailed the government's decision to allow 51 per cent FDI in multi-brand retail while completely opening single-brand retail to overseas investors, saying the move would help bring in the much needed capital for the sector."It is a win-win situation for everyone. With the amount of money to be invested in back-end, supply chain and farm sector will benefit," Future Group Chief Executive Officer Kishore Biyani told PTI. Even the small and medium enterprises will benefit. Eventually consumers will get a lot of choices and they will get products at better prices, he added.

Shoppers Stop Vice Chairman B S Nagesh said: "I welcome FDI in retail. Capital is required for the market whether it comes from domestic or foreign investors, it will help grow the sector in the next 3-5 years."

Commenting on the impact of opening the sector to foreign players he said: "There will be no impact on the domestic industry as there is enough market. At the end of the day the consumer will benefit."

Sharing similar view, industry body CII said it strongly supports the introduction of FDI in multi-brand retail as it would benefit consumers, producers (farmers), small and medium enterprises and generate significant employment.

"This would open up enormous opportunities in India for expansion of organised retail and allow substantial investment in the back-end infrastructure like cold chains, warehousing, logistics and expansion of contract farming," CII President B Muthuraman said in a statement.

Previously, no FDI was allowed in multi-brand retail while in the single-brand retail only 51 per cent was allowed. In the wholesale cash and carry, 100 per cent FDI is allowed.

Source: IANS

25/11/2011

Left, BJP slam government over FDI in retail

The Bharatiya Janata Party (BJP) and the Left Friday slammed the government's move to allow FDI in multi-brand retail trade, saying it will destroy the livelihood of millions of retailers.BJP leader Murli Manohar Joshi called the decision "lopsided and anti-people" and said the party may move an adjournment motion on the issue in parliament.

His colleague Uma Bharti vowed to torch any Walmart outlet that opened anywhere in the country.

The CPI-M came out with a blistering statement, alleging that allowing foreign direct investment (FDI) in multi-brand retail was bound to "destroy the livelihood of crores of small retailers".

It will also "lead to monopolization of the retail sector by the MNCs".

"The government seems more eager to meet the demands of the US and other Western governments and serve the interests of MNCs like Walmart, Tesco and Carrefour rather than protect those of its own people," it said.

BJP's Joshi said the government decision was not in the interest of the country.

He indicated that BJP-ruled states were not likely to follow the revised government norms. "Why are you bringing the problems of Europe and the US in the country?"

He said foreign companies had an eye on India's retail trade which is likely to grow 10 times in the next 10 years.

He pointed out that retail was the biggest employer after agriculture. This "will lead to massive unemployment".

The CPI-M said India had the highest shopping density in the world, at 11 shops per 1,000 people.

"There are over 1.2 crore shops in India employing over 4 crore persons. Ninety-five percent of these shops are run by self-employed persons in less than 500 sq ft area.

"These small shopkeepers in the urban areas are going to be hit the hardest with the entry of the MNC retailers.

Party leader Sitaram Yechury alleged that such a major decision had been taken outside parliament when the house was in session.

"We will not discuss the FDI issue in Parliament unless the government revokes the decision. We will oppose it in the House and outside also," he said.

Communist Party of India's D. Raja called it a "most unwise" move that would displace millions.

Uma Bharti said in Lucknow that she would herself torch any Walmart outlet that opened in the country.

"I will set it on fire with my own hands," she told reporters.

Source: IANS

Full coverage on retail

25/11/2011

Corporate America hails FDI reforms; India sharply divided

The Lok Sabha was adjourned Friday morning after the opposition vociferously protested the government's decision to allow 51 percent foreign equity in the retail sector.Opposition MPs, united in protest, were on their feet as soon as Speaker Meira Kumar called for the crucial Question Hour.

Shouting slogans against the government's decision, the protesting members created ruckus in the house forcing the speaker to adjourn the house till 12. This is the fourth consecutive day of the winter session, which began Tuesday, when Question Hour had to be cancelled in the wake of opposition protests.

Parliament did not run on the first three days of the session due to protests over rising prices and the demand of separate statehood for Telangana region in Andhra Pradesh. However, the Friday protests were against the cabinet decision allowing global chains like Wal-Mart, Carrefour and 7-Eleven to bring up to 51 percent foreign equity to open multi-brand retail stores and 100 percent equity in the single brand format.

Corporate America on Thursday had welcomed the bold move of the Cabinet to permit foreign direct investment in multi-brand retail and remove the cap on FDI in single-brand business, noting that it will help bring down inflation and create thousands of jobs.

"The singular act of opening the multi-brand retail sector to foreign direct investment will significantly benefit the Indian consumer by spurring the modernisation of India's vast agri-retail marketplace," said Mr Ron Somers, President of the US India Business Council.

"Investments will now flow into India's farm-to-market supply chain, which will usher in expertise and bring efficiencies to India's supply chain infrastructure. Food price-rise and inflation will now effectively be tamed," he said.

"Opening the retail sector will create a larger market opportunity for Indian farmers, increasing quality and choice for India's sophisticated consumers," Mr Somers said.

The USIBC -- -- a body that represents the views of Corporate America -- -- hailed India's steady progress in advancing major economic reforms in a statement following Cabinet approval for opening up India's vast multi-brand retail sector to foreign direct investment and removing the FDI cap in single-brand retail.

"This change in policy is a good start to a win-win decision for all stakeholders, including customers, farmers and the government of India," said Dough McMillion, President and CEO of Walmart International, adding that the decision to allow 51 per cent FDI in multi-brand retail gave his company the opportunity to serve Indian customers directly.

These bold reforms have heartened investors from the US, the USIBC said.

The Government's opening of the multi-brand retail sector will benefit Indian consumers by bringing efficiencies and productivity to the farm-to-fork supply chain, while tamping down rising food prices and inflation, the USIBC said, adding that the overall effect of these actions will propel India on the path to becoming the world's third-largest economy, which was earlier predicted to occur by mid-century.

"The Government's bold resolve to move on these complex reforms serves as an assurance to investors that its economic liberalisation agenda begun in the early 1990s is very much on track, even in the face of the global economic downturn," the USIBC said.

Meanwhile, back home, Shares of retail firms surged by as much as 19% on the bourses this morning, a day after the government approved 51% FDI in the multi-brand retail sector and removed the cap on FDI in single-brand retail.

The decision will be a game-changer for the estimated $590 billion (Rs 29.50 lakh crore) retail market dominated by neighbourhood stores.

Cheering the news, shares of Vishal Retail skyrocketed by 18.83% to an early peak of Rs 22.60, while Pantaloon Retail India jumped by 17.12% to a high of Rs 234.95 and Shoppers Stop climbed by 14% to Rs 424.70 on the BSE.

In addition, Trent rose by 11.57%, Koutons Retail advanced by 14.28% and Provogue (India) surged by 14.92% in morning trade.

In a major decision, the government yesterday approved 51% FDI in multi-brand retail, paving the way for global giants like WalMart to open mega stores in cities with a population of over one million.

Previously, no FDI was allowed in multi-brand retail, while 51% was allowed in single-brand retail. However, 100% FDI was allowed in the wholesale cash-and-carry business.

Source: IANS/PTI

25/11/2011

Air India faces whopping Rs 43,777 crore

The total debt of cash-strapped Air India, consisting of aircraft and working capital loans, is Rs 43,777 crore and the governnment has infused Rs 3,200 crore equity to help the airline, Civil Aviation Minister Vayalar Ravi said today."The total debt of Air India, consisting of aircraft loans and working capital bank loan aggregates Rs 43,777.01 crore. The working capital loan is Rs 21511.10 while the aircraft loan is Rs 21412.06," Ravi informed Rajya Sabha in a written reply.

Apart from it, the beleaguered national carrier owes Rs 3,777 crore to airport operators, oil marketing companies, other vendors, interest on working capital loan, interest of IDBA aircraft loans and employee's wage.

"Air India owes Rs 2,300 crore to public sector oil marketing companies, Rs 480 crore as interest on working capital loan, Rs 200 crore as interest on IDBA aircraft loans, Rs 350 crore towards employees wages, Rs 367 crore to other vendors and Rs 75 crore to airport operators," Ravi said.

The national carrier has registered a loss of Rs 5548.26 crore during 2008-09, Rs 5552.44 crore during 2009-2010 and Rs 6994 crore (provisional) during 2010-11.

He said that the government has infused fresh equity of Rs 3,200 crore to help the national carrier.

The airline has prepared a turnaround plan and financial restructuring plan, on the direction of Group of Ministers, which was examined by the Group of Officers.

"The recommendations of GoO have been referred by the GoM for RBI's review and regulatory forbearance on the FRP," he said.

Source: PTI

Reminding the UPA-II government about the need to reverse the negative perception of a 'decision-making paralysis', industry body Assocham made a pitch for second generation reforms in various sectors, including finance, banking, taxation and agriculture.

The negative perception of a 'decision-making paralysis' within the government must be reversed now, or else the opportunity would slip by, the Associated Chambers of Commerce and Industry of India (Assocham) said.

A uniform Goods and Services Tax, with a simplified and long-term Direct Taxes Code, can electrify business prospects, it said. This will restore business confidence and bring in foreign investors looking for robust bond and corporate debt markets, the chamber said in a statement.

Early implementation of market-driven pricing of oil products is imperative to reduce subsidy outgo and conserve oil and gas resources. The government must announce deadlines for introducing inclusion programmes like food security, universal healthcare, insurance and housing as well, ASSOCHAM said.

"This should help in re-connecting with people at large amid corruption scandals and perception of policy paralysis. It is important to gain people's confidence that the United Progressive Alliance means business. However, ways beyond tightening monetary supply must be explored to control upward spiralling inflation," it added.

The government must find a workable formula to acquire land for industries and create urban clusters, the chamber said.

The draft Land Acquisition Bill and R&R Bill should instill confidence among urban infrastructure developers, with the urban population set to reach half a billion by 2020-end, it said.

At the same time, the proposed law should compensate farmers with reasonable returns and they should be made partners in the process through employment and business opportunities, it said.

There cannot be a compromise on the 9 per cent-plus GDP growth target if poverty is to be reduced, Assocham said, adding that the linkage between the growth rate and poverty reduction was getting diluted in the public perception due to many external factors.

The growth-inflation conundrum has to be cracked and supply side issues must get precedence over monetary measures. In this context, multi-brand retail and supply chains with significant foreign investments would energise both farms and industries, as well as pull down consumer prices, it said.

FDI in retail beneficial for realty, FMCG sector: Experts

Published on Fri, Nov 25, 2011 at 18:04 | Source : CNBC-TV18Updated at Fri, Nov 25, 2011 at 18:40

Mediclaim in India ApnaPaisa.com/Mediclaim

Premiums, features & tax benefitsof all 16 health insurance cos Ads by Google

India Inc has lapped up the move. The government faces fire over its decision to liberalize the retail sector, but finally kicked off the second generation reforms yesterday with a green signal to 51% FDI in multi brand retail and 100% FDI in single brand retail.

While the industry has welcomed the government's decision on opening up the retail sector, the opposition has questioned the govt decision saying that it will hit the unorganised sector and will lead to predatory pricing. However, YC Deveshwar, chairman of ITC said that one of the greater positives that this move can achieve is the strengthening of supply chains which is of crucial importance.

Deveshwar feels it depends on how people use the investment in retailing. "Ultimately, it has to be linked to small and marginal farmer and eliminate wastage and strengthen supply chains," he pointed out. Once that happens, the cost will be eliminated, he added.

The realty sector too is cheered up for the move. They believe the move will be a big boost for the ailing sector. Rajiv Singh, vice chairman of DLF said that the move would give the Indian realty players a chance to compete with global peers.

According to Singh, this development would allow the retail sector to build malls, which are more international in size and standards, have a better choice of retailers within the malls and have better capitalise retailers that can provide a better choice and stock to consumers.

"This is a big opportunity for us to build world scale malls," he explained. The retail business, which has been lagging behind, will soon move to a status which will hopefully be in size and revenues equal to the office business, he further stated.

Also watch the accompanying video for Deveshwar and Singh's comments...

http://www.moneycontrol.com/news/business/fdiretail-beneficial-for-realty-fmcg-sector-experts_624522.html

Kishanji was tortured and brutally killed, say Maoists; CRPF says 'young cops have done a good job'

Kishenji, the number three in the CPI-Maoist, was killed in an alleged gunbattle with security forces on Thursday. The Maoists say he tortured.

NEW DELHI/JHARGRAM: The Communist Party of India-Maoist (CPI-Maoist) alleged on Friday that its leader Kishanji was "tortured and brutally killed" after his arrest in West Bengal.

"This murder looks much similar to that of (CPI-Maoist spokesman) Azad's in July 2010 when he was brutally tortured and killed while he was dealing with the union government through (an) interlocutor," it said.

"In these circumstances, the story of a fierce gun battle in Burishol forest of West Midnapore district comes out to be a concocted one," the party said in a statement.

Kishenji, the number three in the CPI-Maoist, was killed in an alleged gunbattle with security forces on Thursday.

In a joint statement, B.D. Sharma, former National Commissioner for Scheduled Caste and Scheduled Tribe, and G.N. Saibaba of the Revolutionary Democratic Front, demanded a judicial probe into Kishenji's death.

They also sought the registration of murder charges against the police personnel who claimed to have killed Kishenji.

Gunfight in which Kishenji died genuine: CRPF

The paramilitary Central Reserve Police Force (CRPF) on Friday expressed indignation over doubts expressed in various quarters over the genuineness of the gunfight that killed top Maoist leader Kishenji and claimed it was a "clean operation".

"When we die in large numbers, it is a fair deal. But when we take them on, it is a fake encounter," said CRPF Director General K. Vijay Kumar who visited the spot in West Midnapore district's Burishol forest where Kishenji alias Koteshwar Rao's body was found Thursday.

"Whatever I have heard makes it look a very clean operation," he said.

"It is a significant achievement. Youngsters have done a good job," said Kumar, praising the security personnel who took part in the operation.

The CRPF and its elite anti-Maoist wing Combat Battalion for Resolute Action (CoBRA) played a key role in the encounter.

He said it was a great example of "two forces (paramilitary troopers of the centre and police personnel of the state) working together".

The CRPF official said the Maoists appeared to be under pressure and as such Kishenji did not have his usual multi-layered security. "Public support for them has also steadily declined."

Asked whether the Maoists could retaliate, Kumar said: "When losses happen at the highest level, there can be some sort of (retaliation). We have alerted our guys. It's a sort of professional hazard."

Deputy Inspector General of Police (Midnapore range) Vineet Goel, who was in the thick of the operation, said some of the Maoist members had run away, leaving Kishenji when the firefight took place.

BKU likely to announce first phase of protest today

Yudhvir Rana, TNN | Nov 25, 2011, 05.38AM ISTAMRITSAR: Irked over the Centre's lackadaisical attitude towards their demands, the Bhartiya Kissan Union (BKU) is likely to announce the first phase of its agitation during a mahapanchayat to be held here on Friday, even as the joint platform of farmers and labour unions, including Jamhuri Kissan Sabha, have decided to skip it.

"We can announce social and economic boycott of government for not fulfilling our demands," said state president of BKU Ajmer Singh Lakhowal on Thursday. Farmers and their leaders from 18 states would attend the mahapanchayat, he added.

BKU leaders, including national president Rakesh Tikaet, presidents of Maharashtra and Delhi units, Vijay Jolly and Yudhvir Singh, respectively, are in the city.

Lakhowal said BKU had met the Prime Minister and urged that their demands be met, like fixing of minimum support price (MSP) of crops including sugarcane, potato, paddy, wheat, among others, keeping in view the recommendations of Swami Nathan commission.

Megh Ran Bhuttar of BKU said they had also demanded fixing of MSP of Pusa 1121, a variety of Basmati, and the PM had assured to do so in a month, but he never kept his promise. BKU had held a dharna in Delhi in October, but to no avail.

Some of the demands of BKU include reservation for farmers and facilities on the lines of SC and ST and separate agriculture budget like that of railways.

http://timesofindia.indiatimes.com/city/chandigarh/BKU-likely-to-announce-first-phase-of-protest-today/articleshow/10863691.cms

Wal-Mart may tie up with 'kirana stores' for bigger India play

Peter Arackal, TNN | Jun 4, 2011, 12.30AM ISTBENTONVILLE (ARKANSAS): US retail giant Wal-Mart has indicated its willingness to partner 'kirana stores' in its India journey with the ministerial panel appointed by the PM favouring foreign investment in multi-brand retail to tame inflation.

The suggestion of the panel, headed by chief economic adviser in the finance ministry, Kaushik Basu, has been rejected by the Opposition and the Confederation of All India Traders (CAIT), who fear that 'kirana stores' will be forced to shut shop if global biggies are allowed in multi-brand retail.

Wal-Mart, however, feels that these fears are unfounded. "Kirana stores will continue to be in India for generations," Doug McMillon, president and CEO of Wal-Mart's international division, told reporters here on Thursday at the company's headquarters. He said that Wal-Mart would continue to invest in the JV with Bharti, creating jobs and helping curb food inflation. He cited the example of Mexico, which allowed FDI in multi-brand retail in 1991 after a heated debate on whether the move would destroy mom-and-pop stores. Twenty years and many giant superstores later, pop-and-mom shops still have about 40% of the country's retail market.

There has been speculation that Wal-Mart may be on the verge of forming another alliance, with Kishore Biyani-led Future group. McMillon denied that there was any trouble in Bharti Wal-Mart, a 50:50 joint venture between Bharti Enterprises and the behemoth from Bentonville. Wal-Mart India CEO Raj Jain, however, did not deny talking to "various people" , including the Future group. "There is no problem with Bharti. As retailers we keep talking to various people, including the Future group. But talks do not mean we have struck a deal," Jain, who is also the managing director and CEO of Bharti Wal-Mart, told TOI. The JV operates wholesale cash-and-carry stores in India under the Best Price Modern Wholesale brand and has so far opened six stores. It plans to open 8 to 10 more stores by next year. "We plan to open stores in Maharashtra, Andhra Pradesh and Chhattisgarh," Jain said. Bharti Wal-Mart today has six outlets, 4 in Punjab and one each in Rajasthan and Madhya Pradesh.

Jain said about 40% of all farm products rot by the time they reach the final point of sale. Apart from the enormous waste that this generates, it creates pressure on food prices. "FDI in multi-brand retail will help in curbing inflation to a great extent,'' he said. Both McMillon and Jain, however, admitted that steep real estate prices in India were a real worry. Jain said even if the government allows FDI in multi-brand retail, things will not change overnight as India is a complex market and the country faces a slew of problems, including infrastructure.

India bars multinational retailers such as Wal-Mart and France's Carrefour from the general retail business. Instead, they invest in cash-and-carry stores that sell to other retailers and business units, in which India allows 100% foreign ownership in cash-and-carry operations. According to estimates, retail sales in India are set to swell to $785 billion in 2015 from $396 billion in 2011 on economic growth, increasing salaries and expansion of organized retail.

Earlier this year, Carrefour opened a cash-and-carry store in Delhi.

Wal-Mart has turned to its international division to offset a slump in its US business, which has seen eight straight quarters of year-on-year negative growth. It remains to be seen whether the retail biggie bucks the trend this quarter when it announce its results during the shareholder meeting here on Friday.

"Our competition is getting better all over the world," said Mike Duke, president and CEO of Wal-Mart at an event on Wednesday, which was attended by about 2,000 associates, including 1,500 store workers who came from 15 countries.

The event took place a day after regulators approved Wal-Mart's $2.4 billion bid to buy a controlling share of South African chain Massmart, after a bitter debate over protectionism in the country with the continent's fastest-growing economy.

(The writer is in Bentonville, US at the invitation of Wal-Mart)

http://timesofindia.indiatimes.com/business/indiabusiness/Wal-Mart-may-tie-up-with-kirana-stores-for-bigger-India-play/articleshow/8717795.cms

FDI in retail: I will set Walmart stores on fire, threatens Uma Bharati

LUCKNOW: BJP leader Uma Bharati on Friday threatened to set on fire Walmart store wherever it opens in the country to register her party's protest against allowing Foreign Direct Investment (FDI) in retail.

"By giving permission to Walmart to directly invest in the retail sector, the Centre has jeopardised the employment opportunities of Dalits, poor and backwards," she told reporters here.

"I would personally set afire the showroom when it opens anywhere in the country and I am ready to be arrested for the act," Bharati said, condemning the decision of the Union cabinet to allow 51 per cent FDI in multi-brand retail and 100 per cent FDI in single-brand retail.

She said that she had apprised BJP presidentNitin Gadkari of her plan of action.

Meanwhile, commenting on her remarks, CPI MP Gurudas Dasgupta in New Delhi said, "This is crazy talk...this is not the way...Having been a member of Parliament, can she speak like this?"

Bharati also ventilated her strong displeasure against Prime Minister Manmohan Singh, UPA Chairperson Sonia Gandhi and Congress general secretary Rahul Gandhi and accused them of "shedding crocodile tears" in poll-bound Uttar Pradesh and expressing "fake anger".

"I too feel angry at the Central and state governments," she said.

If Rahul was really concerned over the plight of dalits, poor and backwards he should ask the Prime Minister to prevent the arrival of Walmart, she said.

"Economic liberalisation has snatched employment opportunities of about 90 per cent of the poor people and benefited only 10 per cent," Bharati said.

| Comprehensive Competition Reforms at Centre State and Sub-State Levels will be Defining Moment in India: Moily |

| The time has come for all the stakeholders in the growth of Indian economy to come forward and launch a national movement to build a culture of competition so as to promote innovation, entrepreneurship and inclusive growth and to be part in ushering second generation of reforms. This was stated by the Minister for Corporate Affairs, Dr M Veerappa Moily at the Conference on Building "Friends of Competition" in India, organised by CUTS Institute for Regulation and Competition (CIRC) and Indian Institute of Corporate Affairs (IICA), Ministry of Corporate Affairs, in New Delhi yesterday. Shri Moily said "the stage is set for competition policy reforms." He added that "as per a recent study, Indian GDP in 2050 will be $85 trillion, ahead of China and the US and in order to achieve this, the second-generation economic reforms at centre, state and sub-state levels are now required. We now need a culture of high productivity, efficiency, innovation or competition. Competition policy and law are instruments which positively affect the bottom of pyramid and therefore will be defining moment within the policy reform agenda. The major objectives of the competition reform measures are to promote sustained high level of economic growth, control inflation, enhance productivity and attain international competitiveness, and generate employment opportunities." The conference was attended by a large number of national and international dignitaries and participants from government, bureaucracy, competition authorities, legal professionals, economists, academicians, research think tanks, media and persons from the civil society. The conference provided a timely and well needed platform for various stakeholders to come and share their views in light of the process of framing of National Competition Policy and amendments to the Competition Act are under way. During various sessions, eminent subject-experts from India and other countries who spoke included: Allan Fels, Dean, Australia and New Zealand School of Government and a former competition regulator from Australia, Dhanendra Kumar, Chairman of the National Competition Policy Committee, Justice SN Dhingra, Member of the CCI, Peter Varghese, Australian High Commissioner, Yashwant Bhave, Chairman of AERA, AK Chauhan, Director General of CCI, Mahendra Swarup, President of Indian Venture Capital Association, Sandeep Varma, Director, Ministry of Defence, etc. The conference is a first step in building networks of to facilitate exchange of ideas, views and experience amongst government, competition authority, civil society organisations and academicians. Samir/kd (Release ID :77572) |

- Election Commission

- ECI Plans to Engage With Citizens & Voters Through Social Media Soon

- Min of Agriculture

- Wheat Sown in about 121 Lakh Hectare And Pulses in 92.94 Lakh Hectare so far; Pulses Acreage up by 5 Lakh Hectare; Sowing of Rabi Crops Picking up

- Use of Bio-Fertilizers Rising

- Access to Easy Credit for Farmers

- NCAER to undertake Study of Prevailing Scenario in Farm Sector

- 18 Seed Banks Operating in the Country

- Min of Commerce & Industry

- Background Material on Cabinet Decision on The FDI in Retail

- Min of Comm. & Information Technology

- Regulation of Unsolicited Calls on Mobile Phones

- Incidence of Cyber Crime Cases

- Launching of 4G And 5G Technologies

- Min of Corporate Affairs

- Comprehensive Competition Reforms at Centre State and Sub-State Levels will be Defining Moment in India: Moily

- Min of Defence

- NCC Team Lift Subroto Cup

- Min of Earth Science

- Agro-Meteorological Services Extended to25, 00,000 Mobile Services users

- Min of Environment and Forests

- Inclusion of Forestry Matters in Policy and Decision Making Process: NFC

- Ministry of Finance

- 18 Proposals of Foreign Direct Investment Amounting to ` 2126.20 Crore Approved

- Over 95% Small Help Groups (SHGs) Loan Accounts are Regular as on 31ST March, 2011

- Government Implements Adwdrs 2008 to de-Clogg the line

- Sub-Committee Constituted by RBI under Shri Y.H. Malegam Submits its Report regarding Micro Finance Sector

- NABARD Monitors Performance of Cooperative Banks to improve their Functioning

- 118 % And 119% Achievement in Ground Level Credit to Agriculture during 2009-10 and 2010-11

- RBI Advices Banks to set up a Special Sub-Committee of DLCC to draw Moniterable Action Plans for Improving CDR

- Min of Health and Family Welfare

- Implementation of PC & PNDT Act

- Min of Home Affairs

- Historic Agreement Signed between Centre, Assam Govt. and UPDS

- Separate Community Policing Wing Considered

- Min of Human Resource Development

- Tiss Guwahati to be Off-Campus Center of Tiss Mumbai

- Pupil-Teacher Ratio

- Proposals to Provide Aakash Tablets to Students

- Survey on Standard of Education in India

- Min of Information & Broadcasting

- Frankfurtrheinmain Region being Promoted as an Attractive Business Location

- Film Bazaar at IFFI-2011 Inaugurated

- Social Responsibility Initiative Launched at IFFI

- Indian Classical Music Gaining Influence: Pandit Rajan Mishra

- Min of Law & Justice

- 2 Judges Appointed to The Gauhati High Court

- Min of Mines

- Royalty Sharing Model

- Mineral Production during September 2011

- Min of New and Renewable Energy

- 48 Cities to be Developed as Solar Cities

- Two more Biomass Cookstove Projects under Implementation

- Renewable Energy Efficiency Proposal

- Solar Projects for Historical Monuments

- Min of Overseas Indian Affairs

- Shri Ravi Inaugurates Heads of Missions Conference of GCC Countries

- Min of Panchayati Raj

- Reservation for Women in Panchayats

- Role of Gram Sabha in Implementing FRA

- Empowerment of Panchayats

- Min of Personnel, Public Grievances & Pensions

- Workshop on Capability Building for Sevottam for States and UTs Concludes

- SSC to recruit over 90,000 Constables in CPOS through Common Process 8,000 Personnel to be Recruited for FCI

- Written Part Result of NDA & Naval Academy Exam (Ii) 2011 Announced

- Min of Petroleum & Natural Gas

- Production of Crude Oil and Natural Gas in the Month of October, 2011

- Min of Power

- Foreign Investment in Power Sector

- 99470 Villages Covered under Rajiv Gandhi Grameen Vidyutikaran Yojana

- India to Develop 10,000MW Hydro Power in Bhutan

- Kishanganga Hydro Power Project

- Power Saving through Bachat Lamp Yojana

- Private Producers Seek Changes in Bidding Guidelines for Power Projects

- NTPC to Establish 4,000MW Power Plants in Karnataka and Chhattisgarh

- Import of Coal For Thermal Power Stations

- Ministry of Railways

- Cancellation/Partial Cancellation/Diversion of Certain Trains to be Effective from 1st December 2011 Keeping in View The Safety of The Passengers

- High Density Routes on Indian Railways Network

- Emergency Response System in Indian Railways

- Recommendations of High Level Committee on Composite Security Plan for Railways

- Min of Road Transport & Highways

- Signing of Ssa Between M/O Road Transport & Highways and State Governments of Bihar, Kerala and Jammu & Kashmir

- Ministry of Tourism

- Special Package for North-Eastern Region

- Development of Ayodhya as Tourist Hub

- Min of Tribal Affairs

- TRIFED

- Min of Women and Child Development

- National Consultation with Civil Society Organizations on the Draft Report of India to the UN Committee on Elimination of Discrimination against Women

http://pib.nic.in/newsite/erelease.aspx?relid=77572

Trinamool leads protests in Parliament against FDI in retail

PTISHARE · PRINT · T+

The government decision to allow FDI in retail disrupted proceedings in Parliament today. Here, members of the Confederation of All India Traders protest against the Central Government seeking entry of FDI in Multi Brand Retail at Jantar Mantar in New Delhi. Photo: S. Subramanium

RELATED

NEWS

Nitish opposes Union Cabinet's decision on FDIBJP continues to oppose FDI in retail: RajnathLeft wants govt to revoke FDI decisionProceedings stalled despite overnight consensusMulti-brand retail FDI to increase supply, tame inflation: MoilyPranab claim specious,short on facts: CPI (M)TOPICS

politicsparliamentKey UPA partner Trinamool Congress on Friday virtually led the charge in Parliament against the controversial decision to allow FDI in retail, an issue which saw a united Opposition forcing repeated adjournments.

Members from Mamata Banerjee's party stormed the Well in the Rajya Sabha and were seen protesting from the aisles in the Lok Sabha against the decision of the Union Cabinet to allow 51 per cent FDI in multi—brand retail and 100 per cent FDI in single—brand retail.

Commerce and Industry Minister Anand Sharma, who made identical statements in both the Houses on the issue, faced angry opposition as also Trinamool Congress members who chanted 'Cancel FDI in retail'

BJP and Shiv Sena members in the Lok Sabha carried placards and banners against the decision that was welcomed by the industry — both in the country and abroad.

Left parties, which have been agitating for long against FDI in retail, were equally forceful in their protests.

As unruly scenes continued, M Thambidurai, who was in the Chair during Zero Hour, adjourned the House till Monday.

With today's adjournment, proceedings in the Lok Sabha and the Rajya Sabha in the first week of the Winter session were almost a washout following turmoil over a host of issues including price rise, black money and separate Telangana.

Keywords: FDI policy, Telangana issue

http://www.thehindu.com/news/national/article2659061.ece?homepage=true

Govt ready to talk with anyone who shuns violence: Chidambaram

PTISHARE · PRINT · T+

PTIUnion Home Minister P. Chidambaram during the signing ceremony of the tripartite MoS among the Central Government, Assam Government and United People's Democratic Solidarity (UPDS), in New Delhi on Friday.

Government on Friday reached a path breaking peace pact with a prominent insurgent group in Assam under which the Karbi Anglong hill district will get more power and a Rs. 350 crore special financial package.

Describing it as a "historic" moment, Home Minister P. Chidambaram said government is ready for dialogue with any group which shuns violence and puts its demands within the framework of the Indian Constitution.

"This is a historic moment....the Memorandum of Settlement will change the face of the Karbi Anglong district in all spheres," he said in a statement.

Friday's agreement, signed by the representatives of the Central and Assam governments and the United People's Democratic Solidarity (UPDS), here came at the end of two-year long peace negotiations.

Under the pact, the Karbi Anglong autonomus district council will get more power and the Centre promised a special financial package of Rs. 350 crore spread over five years.

The UPDS was spearheading a violent insurgent movement in Assam's Karbi Anglong district since its formation in 1999 till May 23, 2002 when it entered into a cease-fire agreement with the government.

"Government has always shown its willingness to enter into a dialogue with any group that is willing to abjure the path of violence and place demands within the framework of the Constitution of India," Mr. Chidambaram said after the signing of the peace pact.

Mr. Chidambaram also urged all groups in the country to give up violence and come forward to find a peaceful solutions to all their perceived problems.

Assam Chief Minister Tarun Gogoi, who was also present on the occasion, said it was a significant moment for Assam, particularly for Karbi Anglong, as the pact would bring peace and development.

The Home Minister said negotiations with another Assam insurgent group Dima Halem Daouga was continuing and was near the final stage and the tripartite agreements with the outfit would be signed shortly.

"Talks with ULFA and NDFB (progressive) are also continuing. Recently, we have authorised (interlocutor) P C Halder to initiate the peace process and hold talks with NDFB (Ranjan Daimary) group," he said.

Keywords: Union Home Minister P. Chidambaram, Assam Government, United People's Democratic Solidarity, tripartite agreement

Investment and industrial output must rise to take care of supply side and growth.

"Governance transformation and an attack on corruption can be simultaneous. UPA-II should give a boost to e-governance, expand high-speed wireless broadband access across the country and encourage online procurement and contract awards," Assocham said.

Much has already been achieved through e-ticketing for railways, besides e-access to government services like land records and filing of income tax and other tax returns.

The National Broadband Policy to network all villages with high-capacity optical fibres and last-mile connectivity though wireless appears to be stuck at the moment, the industry chamber noted.

This is an unacceptable situation and needs to be remedied at the earliest," it said.

The performance evaluation system devised by the Cabinet Secretariat for all higher level officers needs to be widely publicised and put into practice. The government has to demonstrate that the popular perception of policy and administrative paralysis is a thing of the past.

"It must recapture public imagination to counter diversionary agitations through these reformist steps," Assocham said.

The logjam in the power and coal sectors needs to end and civil liability rules for the nuclear power programme must get off the ground. The government must educate people on the benefits of nuclear energy and be firm with elements stirring up undue fears about nuclear energy.

"The government has to demonstrate its capacity for leadership before public perception builds up into a loss of faith in it and in the current governance system," it added.

Amid mounting attack by Opposition and ally Trinamool, Congress top brass including the Prime Minister and party chief Sonia Gandhi today took stock of the situation in the wake of government's decision on FDI in multi-brand retail and gave no indication of any rollback.

Congress, which was tight-lipped on the issue before the Cabinet nod, on Friday hailed the move as one which will promote employment and benefit consumers.

"All those who are in the government are supporting (the move). There may be individual views," Parliamentary Affairs Minister Pawan Kumar Bansal told reporters on a day when UPA ally Trinamool Congress virtually led the charge in opposing the move in Parliament.

In an apparent reference to Trinamool Congress supremo and West Bengal Chief Minister Mamata Banerjee, Mr. Bansal said that Commerce and Industry Minister Anand Sharma has held consultations with all concerned.

Besides Trinamool Congress, the move is being strongly resisted by all the opposition barring the Shiromani Akali Dal, which is a key constituent of the BJP-led NDA and ruling party in Punjab known for its agrarian economy.

Party spokesperson Abhishek Singhvi strongly reacted to BJP leader Uma Bharati's threat to set afire Walmart store wherever it opens.

"You can expect nothing more and nothing less from them who preach tolerance and practice violence. One must not forget the dancing image of the same person, when the Babri Masjid was demolished," Mr. Singhvi said.

He said that FDI in retail is actually going to "promote employment" and offer a much higher degree of choice better quality and compensation to consumers.

Echoing similar views, party general secretary Digvijay Singh remarked on Twitter "fully support 51% FDI in Retail.

Good for Consumer as it would eliminate middle men. It won't affect neighbourhood store and Rural Market."

APA small vendor sells vegetables in New Delhi on Friday. The Commerce Minister Anand Sharma said that the decision to open the country's retail sector to global chains has a built-in safety net for small shops and farmers.

Keeping fuel subsidy limited to target class as Small Trade and Peasantry Killed!Advocating fiscal consolidation and containment of fiscal deficit, Reserve Bank GovernorD Subbarao today termed subsidies given on fuel, fertiliser and irrigation as "bad" ones and stressed on weeding out unproductive expenditure.

Commerce Minister, Anand Sharma on Friday sought to allay fears on the allowance of 51 per cent Foreign Direct Investment (FDI) in multi-brand retail. According to him FDI in retail will not only help farmers but also create jobs.

Delivering the P N Haksar Memorial lecture here, Subbarao said, "In charting a roadmap for fiscal consolidation, we need to be mindful of the quality of fiscal adjustment-- which is to weed out unproductive expenditure and protect growth promoting expenditure," he said.

Sharing his thoughts on subsidies in his address on 'Rejigging the Elephant Dance: Challenges to Sustaining the India Growth Story', Subbarao said, "There are bad subsidies and there are good subsidies".

"Bad subsidies like fuel subsidy, subsidy on LPG may be Rs 300 but every time you buy LPG you are getting subsidy to the extent of Rs 300. Not only you, Mr Birla, Mr Ambani, every time they buy a cylinder, they will also get subsidy," he said.

"Then there is fertiliser subsidy...soil degradation happens because of fertiliser subsidy and thereafter irrigation subsidy," he said.

Subbarao said there were good subsidies as well, like giving cycles to girls to come to school and constructing toilets for girls in schools located in villages. "These are good subsidies," he asserted.

He said about 75 per cent of the government's expenditure constitute payment of salaries, pension etc.

He emphasised on the importance of a stable and predictable macro-economic environment which was necessary for growth.

"Fast growth gained through an excess can be an allure because the signs of instability brewing in underbelly are often not visible real time. But when implosion inevitably happens, the losses by way of lost growth and welfare can be monumental," he said.

Benefits of the fuel subsidy should remain limited to a target class, as higher class has a tendency to use subsidised cheaper fuel more, former chairman of Petroleum & Natural Gas Regulatory Board (PNGRB), L Mansingh, said in Ahmedabad today.

The Finance Ministry today approved 18 FDI proposals, including that of Dish TV and MCX, envisaging foreign investment of Rs 2,126 crore, while referring the application of Unitech Wireless to Cabinet.

The proposals were cleared following recommendations of Foreign Investment Promotion Board (FIPB).

However, decision on 16 proposals including that of Religare Capital Markets and Cordia International Corp, USA, was deferred and 11 were rejected, the Finance Ministry said.

The request of "Unitech Wireless (TN), amounting to Rs 8,250 crore, has been recommended for consideration of Cabinet Committee on Economic Affairs (CCEA)," the statement said.

The company is seeking foreign investment to promote its telecom business including unified access services. FDI proposals envisaging investment of over Rs 1,200 crore and more are referred to CCEA for clearance.

It also said that decision on Vodafone-Essar's request of transfer of shares from resident to non-resident to carry out the activities relating to telecommunication could not be taken as more deliberations were needed.

"(Vodafone Essar's Rs 2,835 crore) proposal has been recommended for the consideration...after the receipt of inputs from concerned departments," it added.

The government cleared Dish TV India's Rs 980 crore proposal to raise foreign equity to produce telecom equipment and marketing of mobile satellite communications.

The statement further said MCX's (Multi Commodity Exchange of India) request for sale of equity shares through an Initial Public Offering (IPO) to Indians and Sebi registered FIIs has also been cleared.

The proposal of Mauritius-based Ventureast Life Fund III LLC seeking induction of foreign equity worth Rs 950 crore in a trust has also been cleared.

"In India, 30 per cent of the total population does not have access to commercial energy, while 33 per cent even don't use energy, which is against the principle of equitable distribution of energy," Mansingh said, at a symposium on 'National Energy Security' at the Institute of Management, Nirma University (IMNU).

Terming the government's fuel pricing policy and selling of subsidised fuel as "not proper", he said, "Nowadays, sale of diesel vehicles is on the rise, despite the fact that they are costlier than petrol vehicles."

"This is because of the tendency of higher class to use cheaper fuel. Therefore, we should have a system, so that, benefits of the subsidy remains limited to a target class," Mansingh said, in his key-note address.

He said that energy security was critical for India, if it wanted to realise its dreams and hence it should take integrated view of the energy scenario in the country and promote use of all kind of energy resources.

General Manager (Commercial) of Gujarat State Petronet Ltd, Ravindra Agarwal, claimed that the coming decade could be utilised for increasing the gas-grid network across India.

"Gujarat amounts to one third of gas consumption of the country with just 5 per cent of the population," Agarwal said in his address.

"The state will double its pipeline network in the next the few years. The demand and supply of gas is never met. Demand increases in tandem with supply. Therefore, we need more LNG terminals and CNG infrastructure," he said, talking about future requirements of the state.

All the speakers, who took part in the symposium, agreed that if India wanted to maintain its growth momentum and achieve higher growth rate, it must meet its energy demand in a sustainable manner.

The one-day symposium was organised in association with Gujarat Energy Transmission Corporation Limited,Gujarat Power Corporation Ltd, Nuclear Power Corporation of India Ltd and Gujarat Industries Power Company Ltd.

Finance Minister Pranab Mukherjeetoday said the tight monetary policy of the Reserve Bank which has helped in curbing inflation has also impacted growth.

"While the increase in repo rate along with other monetary measures has impacted the inflationary pressures favourably, there are visible sign of moderation in the growth of different sectors of the economy," Mukherjee said in a reply to the Lok Sabha.

The Reserve Bank has hiked policy rates 13 times since March, 2010 to contain the near double-digit inflation. Inflation for October stood at 9.73 per cent.

India's GDP growth rate has been projected at 8.5 per cent in 2010-11, but there are apprehensions that it may slip below 8 per cent due to the global economic turmoil, coupled with high inflation and interest rates in the country.

Mukherjee said the impact of such rate hikes is visible on the interest rate sensitive sectors, such as real estate, consumer durables and automobile, where demand is slowing.

He said the government is monitoring the price situation regularly and is working on ensuring price stability. Food inflation, which account of 15 per cent in the overall inflation, stood at 9.61 per cent for the week ended November 12.

He said the government has taken several steps to contain prices of essential commodities by reducing import duty on wheat, onion and pulses to zero.

Besides, a ban on the export of edible oil and pulses and futures trading in rice, urad and tur was among the measures taken by the government to moderate essential commodity prices.

Commerce Minister, Anand Sharma on Friday sought to allay fears on the allowance of 51 per cent Foreign Direct Investment (FDI) in multi-brand retail. According to him FDI in retail will not only help farmers but also create jobs.

Anand Sharma said that the government's new policy would create 10 million jobs over three years, while not affecting smaller, domestic retailers.

Foreign companies investing more than 51 per cent in single-brand retail stores must source at least a third of their products from small domestic industries or village craftsmen, a government statement quoting the trade minister said.

Under the policy the government will have the first right to procure farm products in its new policy allowing foreign supermarkets in India, the trade minister said.

He also said fresh agricultural produce may be sold unbranded in foreign supermarket policy. "FDI policy has been evolved after consulting all stakeholders", he added.

An embattled UPA government hung the 'Open' sign for foreign retailers, ending years of prevarication on an issue that had become a litmus test of its commitment to take forward the next phase of economic.

The cabinet on Thursday faced down opposition from within and outside to allow foreign retailers to own a 51% stake in the multi-brand retail sector, paving the way for global groups such as Walmart, Carrefour and Tesco to open supermarkets in India.

It also allowed 100% FDI in single-brand retail, a decision that will encourage companies such as Sweden's homeware firm Ikea and clothing retailers Gap and H&M to set up shop. Until now, foreign firms were allowed 51% in single-brand retail, while being allowed to own 100% of back-end cash-and-carry operations that serve wholesalers.

The government's decision is fraught with great political risk during what is perhaps the weakest phase in its nearly eight years of governing India. The proposal was opposed by two constituents of the ruling coalition - Trinamool Congress and the DMK, a senior cabinet minister said.

"There was some opposition and concern about announcing it in Parliament but Pranab babu (FM Pranab Mukherjee) prevailed," another cabinet minister told ET.

Besides its coalition partners, the decision could expose the government to criticism in Parliament as the principal opposition party, the BJP, and the Left parties are opposed to allowing foreign firms in India's retail sector.

But the government's decision to press ahead in the face of opposition won it plaudits from industry, especially at a time it has been pilloried for indecision and policy paralysis.

With the entry of foreign supermarket players, farmers across India's six lakh villages stand to gain from greater market access, higher profits, better technology and direct linkage with consumers.

"Direct purchase from farms has hugely benefited small farmers like us who were not getting good returns by selling in the local mandi," said Abdul Majid, from Malerkotla in Punjab, who has been selling vegetables from his one-acre farm to Bharti Walmart ever since it opened its first cashand-carry store in Amritsar. "Payments are directly credited into bank accounts and we are free from commission agents."

Large retailers can expect to save 10%-15 % in commissions by purchasing fruits and vegetables directly. Indian consumers pay up to two and a half times the price paid to a farmer, compared with one and a half times in developed markets where the penetration of organised retail is higher.

Farmers can also benefit from investment in supply chains and logistics by retailers and logistics companies. "There is a huge gap in the consumer and retailer price. The APMC system is of hardly any use to farmers," said Raju Shetti, leader of the Maharashtra-based farmers' association Swabhimani Shetkari Sangathana.

Modern retail has improved the quality of produce globally, pointed out Shrinivas Ramanujam, vice president, Adani Agri Fresh Limited, a logistics and warehousing company that supplies branded apples to large retailers.

Govt readies for big next generation reforms push

HT Correspondent, Hindustan Times

New Delhi, November 18, 2011

First Published: 00:36 IST(18/11/2011)

Last Updated: 09:36 IST(18/11/2011)

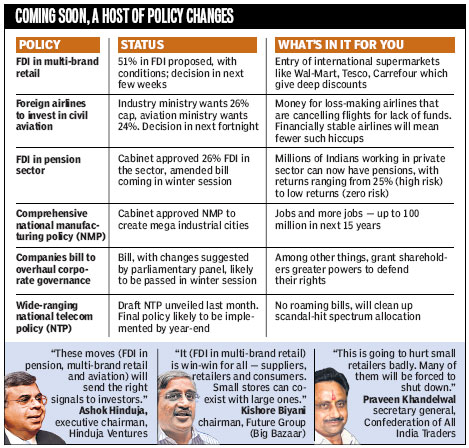

In a bid to counter perceptions of policy paralysis, governance deficit and political drift, the UPA government is poised to introduce a slew of long-pending second-generation economic reforms — including allowing foreign direct investment (FDI) in multi-brand retail and permitting foreign

airlines to invest in domestic aviation companies — over the coming weeks and months.

These legislative and executive measures are expected to put the economy back on a strong growth trajectory, create millions of new jobs and protect the country from the economic contagion currently sweeping across Europe, North America and some other parts of the world.

The finance ministry has cleared a proposal to allow up to 51% FDI in multi-brand retail, but with a few conditions. This means you may, in the foreseeable future, be able to walk into a supermarket run by global retail giants like Walmart, Tesco and Carrefour in your neighbourhood.

The government has also decided to allow foreign airlines to buy up to 24% stakes in India's domestic carriers-a move that will bring cheer, and, more importantly cash, to the loss-making debt-ridden airlines.

The cabinet committee on economic affairs, headed by Prime Minister Manmohan Singh, will take up the matters of FDI in retail and aviation in the next few weeks after which the policy is likely to be formally notified, a source, who did not wish to be identified, said.

Then, on Wednesday, the government announced that it would allow FDI of up to 26% in pension funds and also set up of a pension regulator. Earlier, India's wealthiest man and Reliance Industries chairman Mukesh Ambani joined a growing chorus of experts urging the government to push through policy reforms in critical areas at a pace that matched people's growing aspirations.Ambani's comments came weeks after group of 14 eminent citizens, corporate captains and policy analysts wrote their second "open letter" asking the government to speed up reforms and enact strong lokpal bill to bridge 'governance deficit'.

"There are many measures which the Cabinet can take and that do not require Parliamentary approval. These moves (FDI in pension, retail and aviation) will send out the right signals to investors," Ashok Hinduja, chairman of Hinduja Group told HT.

But politics, as usual, may stymie the government's plans.

The BJP and small domestic traders feel that giant MNC retailers would put the livelihood of neighbourhood mom-and-pop kirana stores and street vendors at risk.

"We have been against this and will continue to oppose it," former finance minister and BJP leader Yashwant Sinha said. "This is going to hurt small retailers badly. Many of them will be forced to shut down shops," said Praveen Khandelwal, secretary general of Confederation of All India Traders.

But industry leaders welcomed the move. "It (FDI in multi-brand retail) is a win-win situation for all-suppliers, retailers and consumers. Small kirana stores can co-exist with large stores," Kishore Biyani, chairman of Future Group, which runs the Big Bazaar chain of stores, told HT.

Left parties termed the moves to open up India's pension, retail and aviation sector to foreign investors as "neo-liberal" and said they would impact the livelihood millions of small traders.

http://www.hindustantimes.com/News-Feed/India/Govt-readies-for-big-next-generation-reforms-push/Article1-770695.aspx

The Elephant That Became a Tiger: 20 Years of Economic Reform in India

by Swaminathan S. Anklesaria Aiyar

Swaminathan Aiyar is a research fellow at the Cato Institute's Center for Global Liberty and Prosperity and has been editor of India's two biggest financial dailies, the Economic Times andFinancial Express.

Share with your friends:

ShareThis

A foreign exchange crisis in 1991 induced India to abandon decades of inward-looking socialism and adopt economic reforms that have converted the once-lumbering elephant into the latest Asian tiger. India's gross domestic product (GDP) growth rate has averaged over 8 percent in the last decade, and per capita income has shot up from $300 to $1,700 in two decades. India is reaping a big demographic dividend just as China starts aging, so India could overtake China in growth in the next decade.When the reforms began in 1991, critics claimed that India would suffer a "lost decade" of growth as in African countries that supposedly followed the World Bank-IMF model in the 1980s. They warned that opening up would allow multinationals to crush Indian companies, while fiscal stringency would strangle social spending and safety nets, hitting poor people and regions. All of these dire predictions proved wrong. Indian businesses more than held their own, and many became multinationals themselves. Booming revenue from fast growth has financed record government spending on social sectors and safety nets, even if these areas are still dogged by massive corruption and waste. Still, poverty is down from 45.3 percent in fiscal year 1994 to 32 percent in fiscal year 2010, and the literacy rate is up from 52.2 percent to 74 percent in two decades, India's fastest improvement ever. Several of the poorest states have doubled or tripled their growth rates since 2004, and their wage rates have risen by over 50 percent in the last three years.

However, India continues to be hampered by poor business conditions and misgovernance. Almost a quarter of Indian districts have recorded some sort of Maoist violence, and corruption is a major issue. India ranks very low on ease-of–doing-business indicators. Rigid labor laws prevent Indian companies from setting up large factories for labor-intensive exports, as in China. Both governance and economic reforms are needed, but progress on the former lags far behind, is thus more urgent, and can help sustain and promote economic reform.

Download the PDF of Development Policy Analysis no. 13 (903 KB)

View this Development Policy Analysis in HTML Get Adobe Reader

Download in other formats: .epub

Share with your friends: ShareThis

http://www.cato.org/pub_display.php?pub_id=13435

Next Generation Financial Reforms for IndiaEswar S. Prasad and Raghuram G. Rajan

A new report advocates a shake-up in India's financial system to underpin growth

India has grown by leaps and bounds in recent years and is emerging as a major world economic power. After lumbering along at a pace of about 4-5 percent GDP growth a year in the 1980s and the 1990s, the economy has surged in this decade, posting an average annual growth of 8.5 percent since 2005 (see Chart 1). The challenge now is to maintain this growth momentum and provide benefits as well as economic opportunities to a broad swath of the population.

India's financial system—comprising its banks, equity markets, bond markets, and myriad other financial institutions—is a crucial determinant of the country's future growth trajectory. The financial system's ability to channel domestic savings and foreign capital into productive investment and to provide financial services—such as payments, savings, insurance, and pensions—to a vast majority of households will influence economic as well as social stability.

While India's financial institutions and regulatory structures have been developing gradually, the time has come to make a more concerted push toward the next generation of financial reforms. A growing and increasingly complex market-oriented economy, and its greater integration with global trade and finance, will require deeper, more efficient, and well-regulated financial markets.

These considerations prompted the Indian government to institute a high-level committee—composed of a select group of financial sector practitioners, businesspeople, academics, and policymakers—to map out a blueprint for financial reforms. After more than six months of intensive work, the committee recently delivered its draft report to the government (available at http://planningcommission.nic.in/reports/genrep/report_fr.htm). In this article, we summarize the key findings of the report and examine its recommendations.

Three main conclusions

Numerous other government committees over the years have looked into specific aspects of India's financial reforms, but this is the first committee mandated to "outline a comprehensive agenda for the evolution of the financial sector." Indeed, the report argues that there are deep linkages among different reforms, including broader reforms to monetary and fiscal policies, and recognizing these linkages is essential to achieve real progress.

The report has three main conclusions. First, India's financial system is not providing adequate services to the majority of domestic retail customers, small and medium-sized enterprises, or large corporations. Government ownership of 70 percent of the banking system and hindrances to the development of corporate debt and derivatives markets have stunted financial development. This will inevitably become a barrier to high growth.

Second, the financial sector—if properly regulated but unleashed from government strictures that have stifled the development of certain markets and kept others from becoming competitive and efficient—has the potential to generate millions of much-needed jobs and, more important, have an enormous multiplier effect on economic growth.

Third, in these uncertain times, financial stability is more important than ever to keep growth from being derailed by shocks hitting the system, especially from abroad. Although the Indian economy dodged the Asian crisis and the recent subprime crisis, a lot remains to be done to secure the stability and durability of the financial system.

Where things stand

The report finds that the Indian financial system has made significant strides in recent years. India's stock exchanges, in particular, have developed well and become a vital source of funding for enterprises and an alternative savings instrument for households. Stock market capitalization has risen significantly—aided by financial inflows from abroad—and the technical infrastructure of equity trading is state of the art (see Chart 2).

The Indian government has taken a number of steps to improve the banking system. Banking reforms, which started nearly two decades ago, have increased the efficiency of the banking system, and the ratio of nonperforming loans to deposits is about 1 percent—a remarkably low level. Many of the public sector banks have become quite profitable and well capitalized, and they coexist with a vibrant private banking system.

However, in terms of overall financial depth—the size of the financial system relative to the economy—India does not compare favorably with other countries or even most other emerging markets at a similar stage of development. Despite the apparent strength of the banking system, the ratio of private sector credit to GDP is still low by international standards (see Chart 3). Some of the restrictions on the banking system, and the incentives for banks to hold government bonds rather than make loans, have stifled lending. Consequently, the average ratio of loans to deposits in the Indian banking system is much lower than in most other countries.

The government bond market appears large—public debt amounts to about 70 percent of GDP—but much of the stock of government bonds is held by banks, a requirement prescribed by the "statutory liquidity ratio," and is not traded. The corporate bond market remains woefully underdeveloped, with the total capitalization amounting to less than 10 percent of GDP. Regulatory restrictions have also kept certain derivatives markets, especially for currency derivatives, from developing.

The absence of these markets is being felt sorely as India's capital account has become more open over time, potentially leading to greater short-term currency volatility. India is seen as an attractive destination for foreign capital, which has meant large inflows in recent years through various channels, especially portfolio equity investment by foreign investors (see Chart 4). The financial system faces ever-greater challenges in intermediating the rising amounts of foreign as well as domestic capital in an efficient way to the most productive investments. At the same time, it will be important not to let the capacity and expertise to regulate financial markets fall too far behind innovations in these markets.

Clearly, there are big challenges to achieving further financial reforms. Let us start with the big picture.

Fine-tuning macroeconomic policies

Why do macroeconomic policies matter for financial reforms? The links between macroeconomic management and financial development are deep and run in both directions. Disciplined and predictable monetary, fiscal, and debt management policies create a foundation for financial sector reforms. In turn, a well-functioning financial system is essential for the effective transmission of macroeconomic policies.

Whatever their faults might be, India's macroeconomic policies have delivered high growth and, until recently, stable inflation. Why fix what ain't broke? Because, in the memorable words of Bob Dylan, the times they are a-changin'.

Cross-border capital flows—both inward and outward—have ramped up and are likely to remain large and volatile, creating huge complications for monetary policy as these flows affect the domestic money supply, the exchange rate, and so on. Reimposing capital controls is not a good option; even existing controls are losing their potency as agile investors invariably find ways to evade them. The only viable alternative is to have predictable and consistent policies that at least do not create volatility themselves and that give policymakers the flexibility to respond rapidly to shocks.

What are the options for monetary policy, especially now that the demands on it are growing as the economy becomes more open and exposed to a wider array of domestic and external shocks? The Reserve Bank of India (RBI), India's central bank, has done a good job of managing the multiple mandates foisted upon it—keeping inflation under reasonable control, managing some of the pressures on the exchange rate, and coping with capital inflows—all against the background of strong growth. But there is a risk that this high-wire act has reached its limits. The recent volatility in the rupee has revived calls for the RBI to more actively manage the exchange rate, which is becoming increasingly difficult as the capital account becomes more open. Sustained intervention in the foreign exchange market can also create unrealistic expectations about the RBI's ability to manage multiple objectives with one instrument.

Focusing on a single objective—low and stable inflation—is ultimately the best way that monetary policy can promote macroeconomic and financial stability. This does not mean sacrificing or ignoring growth. Indeed, well-anchored inflationary expectations may well be the best tonic that monetary policy can provide for growth. Contrary to what some commentators seem to believe, there is no long-run trade-off between growth and inflation, and for monetary policy to try and engineer a short-run trade-off can be dangerous. In short, the inflation objective would in fact make monetary policy more effective and strengthen the RBI's hands rather than pinning them down.

India's fiscal policy also needs a makeover. There has been encouraging progress in reducing the budget deficit, but this may just be a cyclical improvement as a result of a strong economy. Recent events, such as the government's waiver of certain farm loans and the growing oil subsidies, raise serious concerns that fiscal rectitude may fall prey to the election cycle. Large deficits raise the specter of future inflation, and they could also suck up funds that would otherwise be available for private investment.

The size of government budget deficits matters for financial reforms also because the deficit is partially financed by getting banks to buy government bonds. Durable reductions in the fiscal deficit and public sector borrowing requirement are therefore crucial to reduce the constraints on monetary policy (as prospects of large deficits make it harder to manage inflationary expectations) and allow financial sector reforms, especially banking reforms, to proceed.

Promoting financial inclusion